What types of properties does the Underused Housing Tax (UHT) apply to? The answer to this question for real estate investors isn’t as straightforward as it may first seem. Below I have listed properties that it does and doesn’t apply to. You can also see more questions that you should be asking about the UHT in this article.

Nov 2023 UPDATE: The federal government proposed significant changes to the rules for UHT filings. Significantly fewer people will now have to file the UHT returns, and they have reduced the minimum failure to file penalties. For details, please see, UHT relief may be on the horizon.

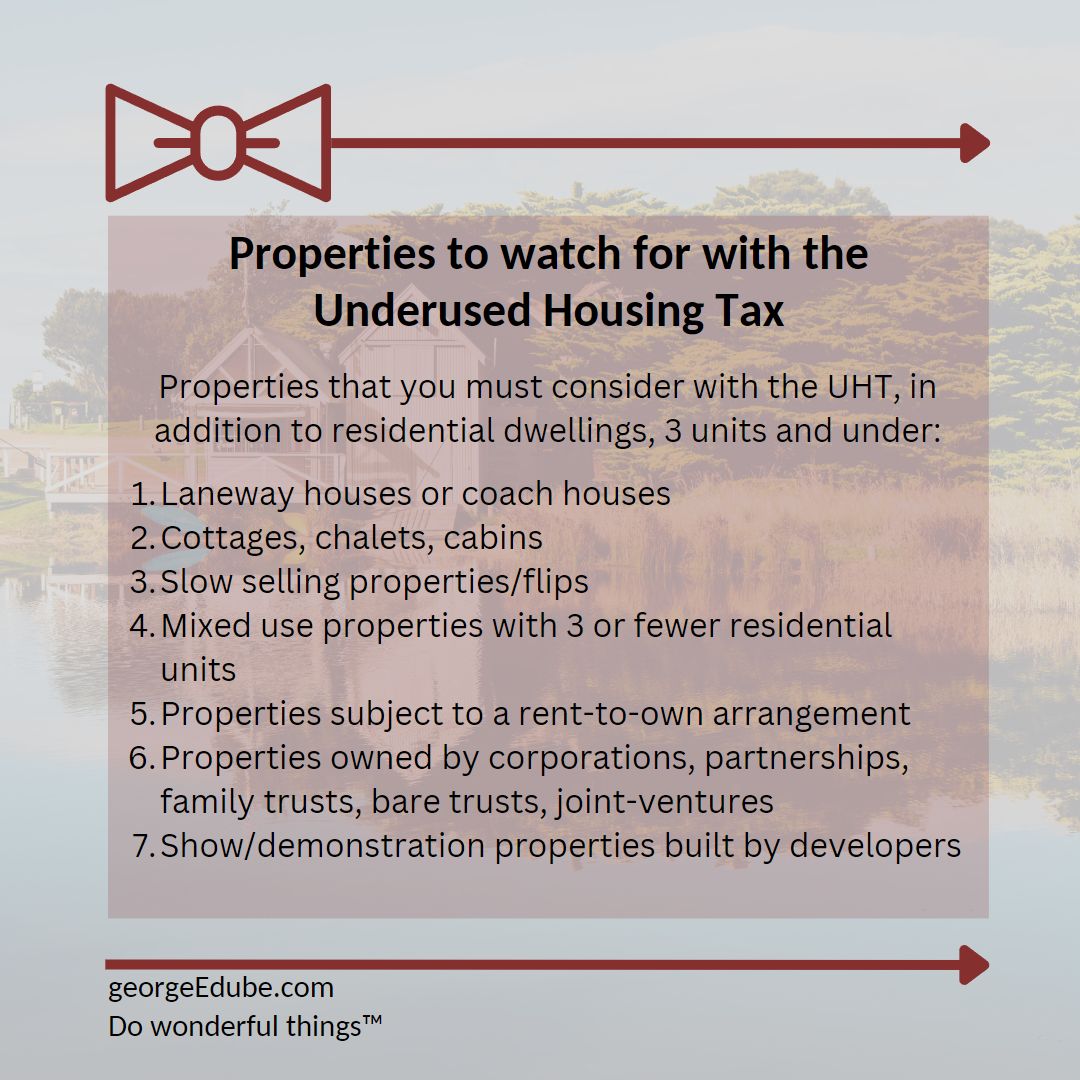

Properties to watch for with the Underused Housing Tax

Beyond what may be more obvious as part of the legislation (residential dwellings of 3 units and under), consider:

- Laneway houses or coach houses

- Cottages, chalets, cabins

- Slow selling properties/flips

- Mixed use properties with three or fewer residential units

- Properties subject to a rent-to-own arrangement

- Properties owned by corporations, partnerships, family trusts, bare trusts, joint ventures

Be careful with spousal partnerships, bare trusts within your own corporation, and JVs where you own a fractional percentage and your corporation owns the remainder. - Show/demonstration properties built by developers – which in some cases may actually be rented back to the developer from a separate owner. Watch the details!

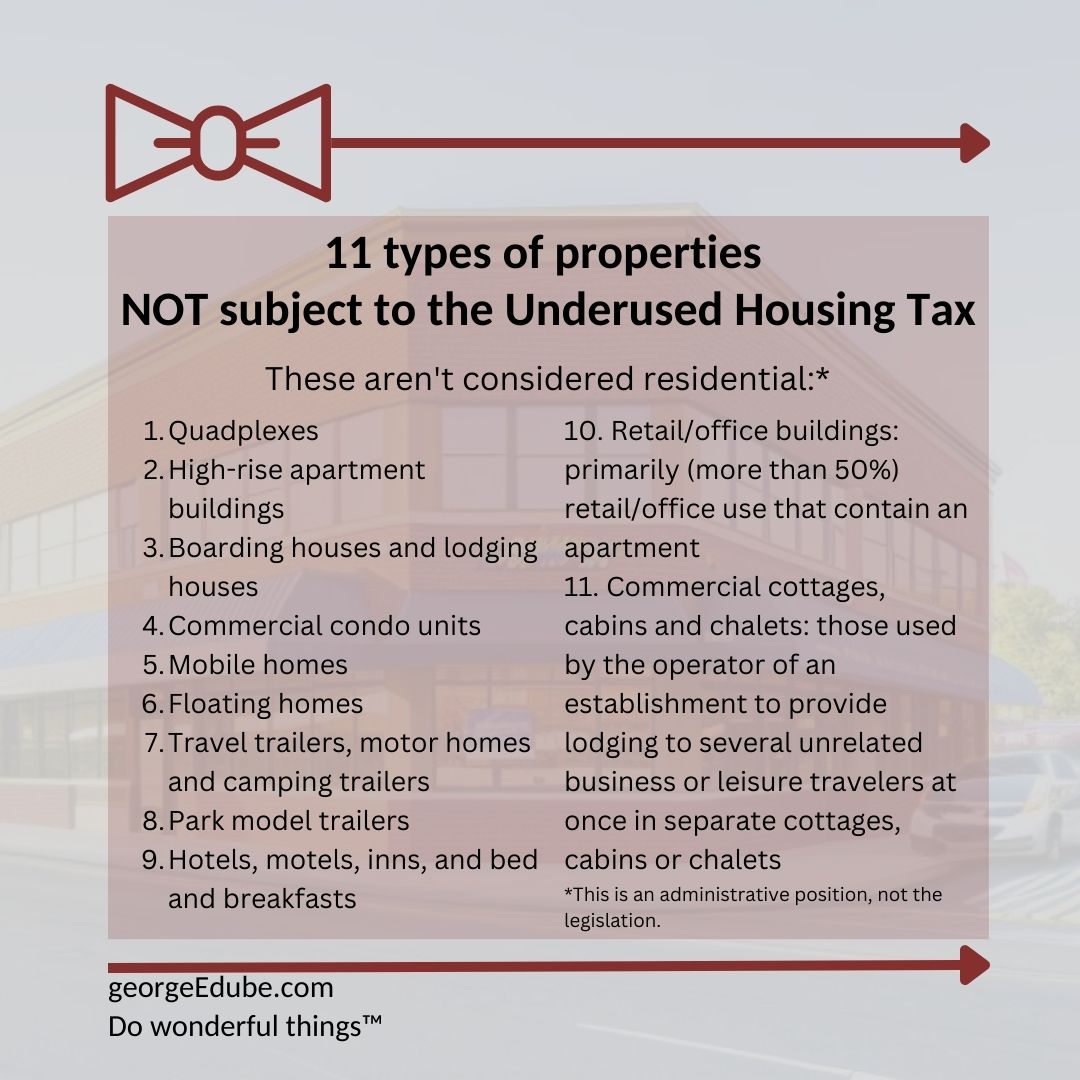

Properties NOT subject to the Underused Housing Tax*

The following are examples of properties that are NOT considered residential, so not subject to the UHT. *This is an administrative position (UHTN1), not the legislation, which means real estate investors still need to use caution.*

- Quadplexes (buildings that have four dwelling units)

- High-rise apartment buildings

- Boarding houses and lodging houses

- Commercial condominium units

- Mobile homes

- Floating homes

- Travel trailers, motor homes and camping trailers

- Park model trailers

- Hotels, motels, inns, and bed and breakfasts

- Buildings that are primarily (more than 50%) for retail or office use and that contain an apartment

- Commercial cottages, cabins and chalets (that is, those that are used by the operator of an establishment to provide lodging to several unrelated business or leisure travelers at once in separate cottages, cabins or chalets)

Watch for more on properties affected by the UHT

Looking for more resources on the UHT?

Underused Housing Tax Tips and Tricks

Underused Housing Tax penalties and interest waived

Underused Housing Tax Return and Election Form

What should real estate investors do next?

- Determine whether you need to file for your various properties.

- If you need to file, determine what, if any, exemption is available to you.

- Ensure you and your advisors know who is filing the tax returns, and leave enough time to complete!

- Ensure you file by April 30, 2023 (or this year, May 1 as April 30 falls on a Sunday).

- UPDATE: The CRA has provided relief for the UHT by waiving all filings, penalties, and interest until October 31, 2023 for 2022 UHT returns. Details on the CRA web site at: Underused Housing Tax penalties and interest waived.

- Nov 2023 UPDATE: The federal government proposed significant changes to the rules for UHT filings. Significantly fewer people will now have to file the UHT returns, and they have reduced the minimum failure to file penalties. For details, please see, UHT relief may be on the horizon.

Still have questions? I want to help you Do Wonderful Things™ with your real estate investments, so please contact me today.