The Underused Housing Tax is generating many questions for real estate investors across Canada. I have been spending many hours researching this new tax, its impact on investors, and its impact on my own portfolio with our family and our joint ventures. I answer 8 key questions about the tax that I think that those investing in real estate should be asking.

A little background on the Underused Housing Tax (UHT)

Canada’s new UHT, which is applicable for 2022, will catch many property owners off-guard. Even where you don’t have to pay the tax, but still have to file, failure to file and late filing penalties can be financially devastating.

If the 1% tax on the value of your residential property doesn’t get your attention, consider the starting point of late filing penalties at $5,000 per property if individually owned, or $10,000 if corporately owned. While provisions exist to charge lesser amounts, now you’re relying on administrative concessions from the Canada Revenue Agency, which can be dangerous. In theory, the tax was geared to non-Canadian citizens/residents, but the phrasing in the legislation ensnares many real estate investors. Most investors will not be subject to the taxes, but they can still be subject to the massive penalties.

And…this tax is in addition to those enforced by municipalities or regions, such as those in Ontario and BC.

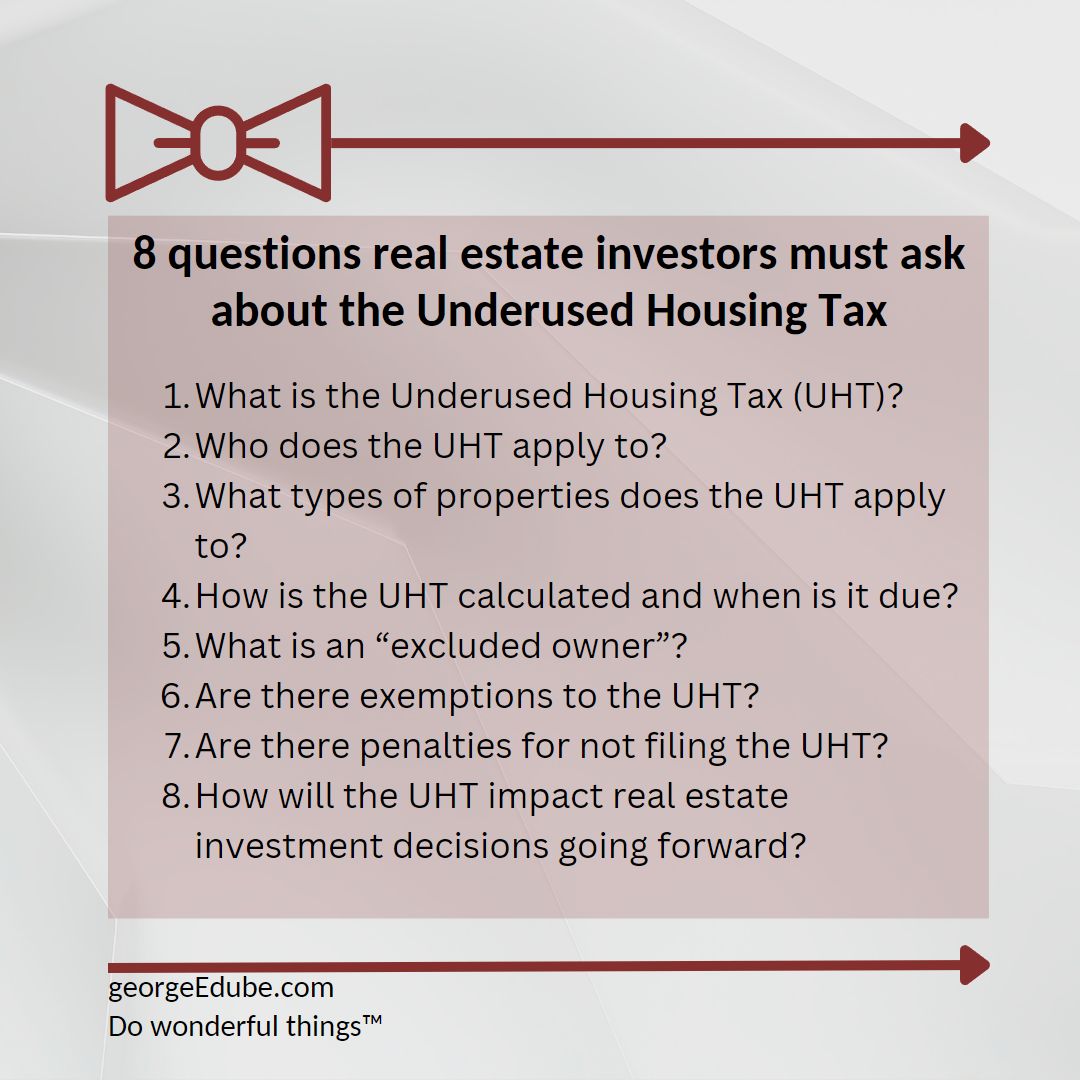

Questions real estate investors need to ask

Nov 2023 UPDATE: The federal government proposed significant changes to the rules for UHT filings. Significantly fewer people will now have to file the UHT returns, and they have reduced the minimum failure to file penalties. For details, please see, UHT relief may be on the horizon.

These questions include:

- What is the Underused Housing Tax (UHT)?

I’ll give a brief over about what this new tax is all about. - Who does the UHT apply to?

This is a really key question for investors – it boils down to “does this tax apply to me”? The answer isn’t as easy as it may first appear. - What types of properties does the UHT apply to?

I cover the key types of properties that the UHT covers – but do we have all the answers yet? See Underused Housing Tax: Properties affected. - How is the tax calculated and when is it due?

- UPDATE: The CRA has provided relief for the UHT by waiving all filings, penalties, and interest until October 31, 2023 for 2022 UHT returns. Details on the CRA web site at: Underused Housing Tax penalties and interest waived.

- What is an “excluded owner” for the purpose of the tax?

This one is particularly important for investors, as you may have many different types of ownership with your investments. - Are there exemptions to the UHT that real estate investors must know?

The short answer is yes, there are, but the list is long and I needed to make sure I had my notes to answer this one in the video. And some of the exemptions need very careful attention otherwise these will catch people unaware. - Are there penalties for not filing the Underused Housing Tax?

This may seem like a silly question, but the penalties can be serious indeed. - And, what may be most important for you, how will the UHT impact real estate investment decisions going forward?

There will be many changes investors will make – many of which are uncertain until we see the full impact. I provide a list of points to take into account right now.

Looking for more resources on the Underused Housing Tax?

Underused Housing Tax penalties and interest waived

Underused Housing Tax Tips and Tricks

Underused Housing Tax: Properties affected

Underused Housing Tax Return and Election Form

What should real estate investors do next?

- Determine whether you need to file for your various properties.

- If you need to file, determine what, if any, exemption is available to you.

- Ensure you and your advisors know who is filing the tax returns, and leave enough time to complete!

- Ensure you file by April 30, 2023 (or this year, May 1 as April 30 falls on a Sunday).

- Ensure you file by April 30, 2023 (or this year, May 1 as April 30 falls on a Sunday).

- UPDATE: The CRA has provided relief for the UHT by waiving all filings, penalties, and interest until October 31, 2023 for 2022 UHT returns. Details on the CRA web site at: Underused Housing Tax penalties and interest waived.

- Nov 2023 UPDATE: The federal government proposed significant changes to the rules for UHT filings. Significantly fewer people will now have to file the UHT returns, and they have reduced the minimum failure to file penalties. For details, please see, UHT relief may be on the horizon.

Still have questions? I want to help you Do Wonderful Things™ with your real estate investments, so please contact me today.