GP/LP structure growth, from simple to more complex, can be an inevitable step for real estate investors. As their businesses grow, their needs grow. Their requirements for flexibility, as well as tax protection, asset protection, and legal protection grow from simpler to more complex, and their GP/LP structure must reflect this reality.

Video Transcript: GP/LP structure growth

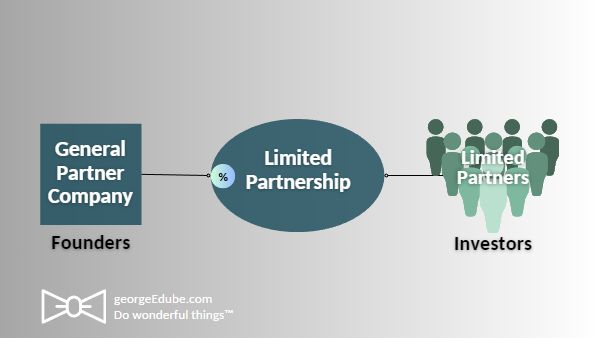

So we’ve seen a more simplistic and basic GP/LP structure for what a lot of real estate investors like to see.

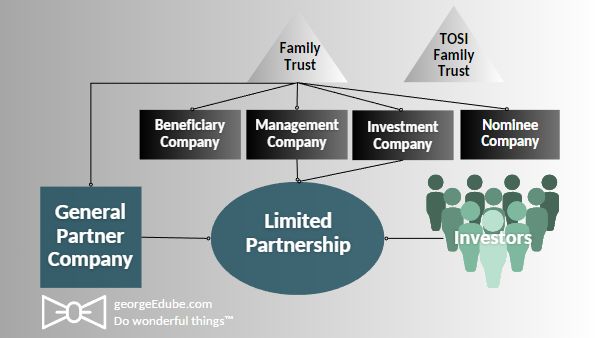

But that structure can become more complex as you’ll see in this graph.

I’m George Dube, saving the world from tax, one bow tie at a time®.

And it’s not to say that you need every element of this.

We’re trying to present some possibilities that you should be talking with your advisors about in terms of whether or not it’s right for you today or maybe it’s something that you morph into over a period of time.

Nominee corporation

So starting that off, one of the things we often speak with people about is whether the founder should have a nominee corporation. So a nominee corporation would actually hold title to the real estate. For some legal reason, the limited partnership itself is not allowed to hold title to the real estate, and so it’s usually going to be either the general partner, that corporation we discussed, or alternatively a nominee corporation. And while from a tax perspective, I’m not aware of any difference. From a legal perspective I’ve been told, and again, something to confirm with your legal team that the nominee corporation may be of assistance from a land transfer tax perspective, in terms of some possible transactions in the future.

Management company

Other things to be considering, should there be for the founders, a management company?

A management company may take some of the activities away from the general partner. So if the general partner is in some way almost a magnet, if you will, for lawsuits then we don’t necessarily wanna see a whole lot of revenue stream going through the general partner. Based on the advice from your legal team, we may then set up a separate management company where that income can flow through to.

So for example, there may be an operating fee a guarantee fee, a closing transaction fee a financing fee, a this fee, a that fee, there can be a multitude of different fees provided that the investors are accepting of these through the limited partnership agreement.

Investment company

We may in addition to that, have an investment company created. That investment company, it’s the intention there for the founders, instead of just having a relatively small fraction of a percentage of ownership, they may actually as well be putting some cash into the project and wanna isolate the investment away from the general partner.

So setting up the separate company to hold their investment within the LP, is often something that makes sense.

Family trust

We may in many cases create a family trust. That family trust often owns that management company, the investment company, and may also own something called a beneficiary company.

Beneficiary company

Without getting into all the details, the beneficiary company may be thought of as almost a storage facility for cash flow. There can be legal and tax reasons for that.

TOSI family trust

We can go another step, and again this may not be on day one and often is not quite frankly, but we may set up what I’m gonna call a TOSI family trust. And largely the purpose of that is to be able to split income with the founder’s family while meeting requirements from Revenue Canada in terms of how we can and can’t do that splitting.

Simple to complex: Growing the GP/LP structure further

So on day one we may have a very simple structure but it may be something again, we grow into a more complex structure over time. You need to be discussing with your accounting and legal advisors and finance advisors, quite frankly, what that structure should look like for you and when you should go to the next level.

No question, this series of recordings on the GP/LP structuring (GP/LP playlist), is very high level, not a lot of detail.

Please feel free to reach out, set up a time to talk further and we can get into the nuts and bolts for what’s right in your specific situation.

Have more questions? Please subscribe, follow and even share.

I want all of us to have the tax information that we need to Do wonderful things®.

-End transcript-

Resources for GP/LP structure growth

For additional resources related to the GP/LP structure growth:

- What is a GP/LP structure for real estate in Canada?

- Who should consider setting up a GP/LP structure

- How to set up a GP/LP structure

Back to: GP/LP structure: Ultimate guide for Canadian real estate investors

More questions?

Still have questions? I want to help you Do wonderful things® with your real estate investments, so please contact me today.

Remember – circumstances are unique! This information is summary in nature. Seek out advice from your tax advisor about your specific situation.