What is a GP/LP structure (General Partner/Limited Partner) for Canadian real estate businesses? Learn what the GP and LP are, and what role each of them play in this type of real estate investing business, including the founders and the investors, what the expectations of each are, and what are some of the restrictions they have.

Video Transcript: What is a GP/LP structure?

So to start off with an obvious question is what is a GP and LP structure?

I’m George Dube, saving the world from tax one bow tie at a time.

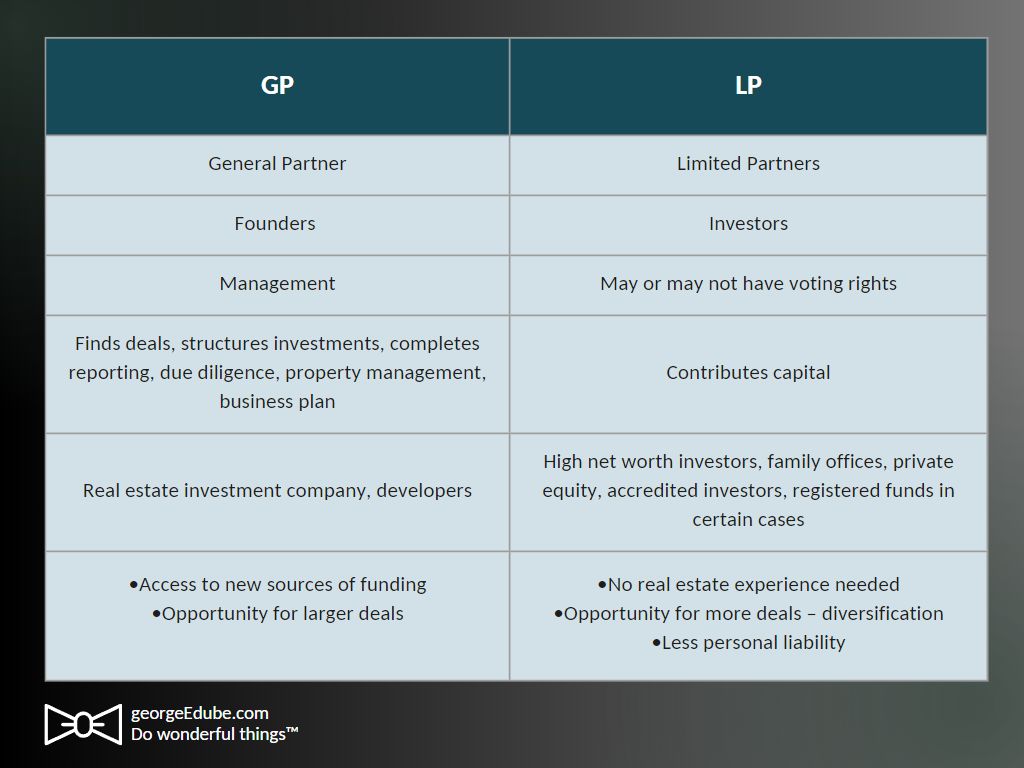

The GP stands for General Partner the LP, Limited Partners or Limited Partnership.

The General Partner, think of it as the founders of a company, the founders of the Real Estate project. They’re going to have an entity that is going to complete the management, the activities of the real estate project. The limited partners through the limited partnership are providing the funds or the predominant portion of funds for the project itself.

And these are going to typically be, not required, higher net worth individuals and they may be looking for certain tax advantages or reporting requirements or advantages, financing advantages, there’s a host of reasons that someone may be looking for the opportunity to be a limited partner.

The founders are looking for the opportunity to bring the limited partners into the fold for the investment, while ensuring that they have control over the operations. Let’s move over to the elements of that GP/LP structure.

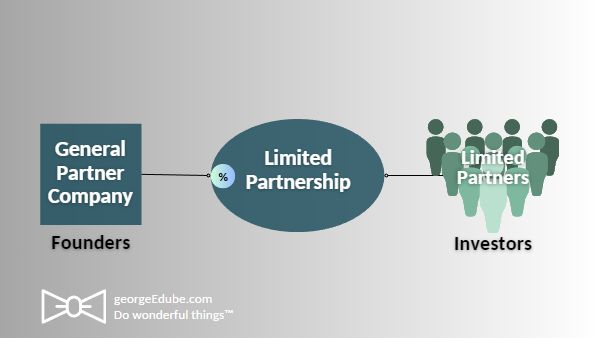

In the simplest format, there is going to be the limited partnership itself and graphically for whatever reason, in tax 101, accountants are taught thou shall draw an oval for a partnership. So when you’ll take a look at our structures this may help you interpret a little bit what’s going on. That limited partnership is gonna have one or more, typically it’s gonna be more, limited partners and in turn it’s going to have a general partner.

Traditionally, that general partner is a corporation with very little in terms of assets and normally, not always, normally owns a fraction of a percent of the limited partnership itself. That general partner is going to be doing, what I’ll call the majority of the activities in terms of running the limited partnership.

The limited partners, as I understand it from a legal perspective, keeping in mind I’m not a lawyer and you need legal advice, are not allowed actually to be involved in the management of the company or in this case, the partnership. If they do get involved, they may, and again talk with your lawyers, lose their limited liability. So a huge incentive for the limited partners not to be involved in managing and directing what’s going on with the project itself. And a huge incentive and ability for the founders, the owners of the general partner to take care of business do things the way they want, provided their meeting their requirements, and fulfilling the agreement of the limited partnership itself.

No question, this series of recordings on the GP/LP structuring (GP/LP playlist), is very high level, not a lot of detail.

Please feel free to reach out, set up a time to talk further and we can get into the nuts and bolts for what’s right in your specific situation.

Have more questions? Please subscribe, follow and even share. I want all of us to have the tax information that we need to do wonderful things.

-End transcript-

Resources

For additional resources related to the GP/LP structure and Canadian real estate businesses:

- GP/LP structure growth: Simple to complex

- How to set up a GP/LP structure

- Who should set up a GP/LP structure?

Back to: GP/LP structure: Ultimate guide for Canadian real estate investors

More questions?

Still have questions? I want to help you Do Wonderful Things™ with your real estate investments, so please contact me today.

Remember – circumstances are unique! This information is summary in nature. Seek out advice from your tax advisor about your specific situation.