George Dube here, your tax-saving guide, donning bow ties and unraveling the mysteries of bare trusts in this year’s tax filing. So, what on earth is a bare trust? Let’s break it down. It’s when someone holds assets for someone else—simple, right? But it’s crucial to identify if you have a bare trust, especially with the new filing requirements looming.

Consider this: joint ventures in real estate might just hide a sneaky bare trust. Imagine legally owning a property but splitting profits with Sarah or Ahmad —yep, that’s a bare trust scenario. Then there’s the property purchase game. Sometimes, for tax or legal reasons, it’s in my name but really owned by my corporation. Tricky, huh? Special shares, a rare bird in real estate, often pop up in healthcare, but picture a parent holding shares for their minor child. It happens, and it’s a bare trust. And don’t overlook the bank accounts. Holding onto an account for an elderly parent or minor child? Bingo! Another example of a bare trust.

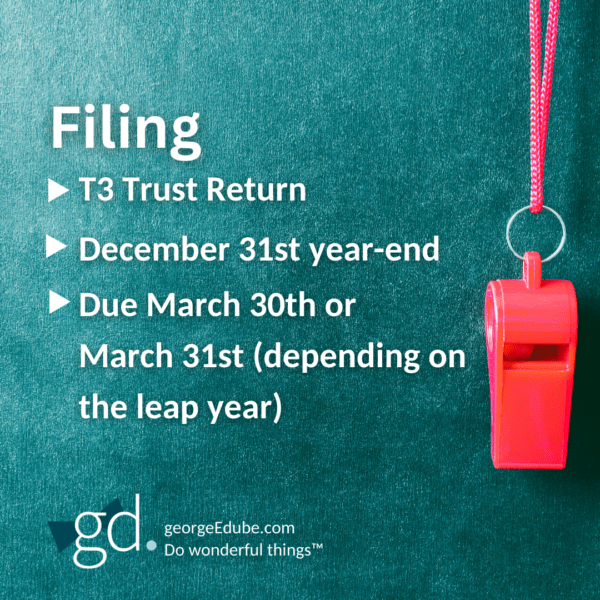

Now, why the fuss about filing? Before, filing for a bare trust wasn’t a thing. But welcome to the new era! Now, by March 30th or 31st (watch out for leap years), we’ve got to file a T3 tax return with a year-end of December 31st, reflecting all the yearly activity, or face large potential penalties. So, get ahead of the game. Talk to your accounting team, identify your potential bare trusts, and let’s tackle this before it becomes a March madness scenario. Trust me, we don’t want those penalties snatching your hard-earned cash. For more details, check out the video and full transcript below.

NOTE:

Canada Revenue Agency Update, March 28, 2024: In what can only be described as an unbelievable and poorly-timed decision, the CRA walked back the requirement to report on bare trusts for 2023 just days before the filing deadline. For full details, see Bare trusts are exempt from reporting requirements for 2023.

Canada Revenue Agency Update, December 1, 2023: Significant updates were made on December 1, including an announcement that they may provide relief from interest and late filing penalties for 2023 for bare trusts. This only applies for 2023 returns and only for bare trusts that are inadvertently missed.

My 2 cents on this “significant update”: Let’s not get overly excited. The CRA may provide relief and may do this if it’s inadvertent (who defines what inadvertent means?) and may do this only for 2023. This sounds a whole lot like “please follow the rules or you’re at significant risk”.

Video Transcript: Bare trusts: New reporting rules may catch you off guard

Good day.

We’re going to be talking about bare trusts and the new tax filing requirements that are applicable this year.

I’m George Dube, saving the world from tax one bow tie at a time.

Sure, many people won’t know what a bare trust is and so we’re going to go through that. And because of the penalties involved with not filing these new returns, I’m going to encourage you to determine whether or not you do have a bare trust and if so, to get those filed before the deadline.

What is a bare trust?

So, let’s start off with what exactly is a bare trust And in doing so is a real, real loose definition. I’m going to suggest that a bare trust is a relationship where an individual or an entity is going to be holding an asset or group of assets on behalf of someone.

Common examples of bare trusts

Bare trusts: Joint ventures

So, some of the common examples that we’re going to see first it’s to show what a joint venture may look like from a real estate perspective. We often focus on joint venture, not realizing behind the scenes effectively there may be a bare trust. So, for example, if I am going to be holding title to the property legally, but I’m only getting 50% of the profits, losses, et cetera, and I’m working with Billy Bob or Betty Sue for the other half, there’s a bare trust there. I’m taking control of it. I’ve got title for someone else, so I’m going to need a new trust requirement or filing requirement.

Bare trusts: Buying a property

Our second example relates to buying the actual property. Again, a bare trust can exist and we certainly see lots and lots of examples where often for financing purposes it may be the property’s in my personal name and I am going to own that effectively or hold it on behalf of my corporation. So, in other words, for tax reasons and legal reasons, I may want that property to be in the corporation, but I wasn’t able to do that or was not talking to the right people in terms of how to actually close on a property or refinance a property without using my personal name.

Bare trusts: Special shares

Next example, special shares. And again, this is not something I usually see from real estate investors. I see a lot in the healthcare industry, but it’s in theory applicable to you. Pick the industry. And the basic concept is that at times, instead of creating a formal, what I’m going to call a discretionary family trust, someone was trying essentially to just have a bare trust where a parent in most cases would hold special shares on behalf of their minor child. So, once the minor child reached the age of majority, they were legally allowed to own the shares; title to those shares would go to the child. So, again, various industries I saw a lot or see a lot in the healthcare industry. So, watch out for that.

Bare trusts: Name on bank account or investment account for elderly parent or minor children

Our last example, and there’s certainly other examples that exist, but one that we’ll see on a regular basis: an individual may hold or, typically speaking, have their name added to a bank account or an investment account for a parent, an elderly parent generally speaking. Thus they are trying to reduce the amount of probate fees depending which particular province or territory we’re talking about. There’ll be similar names, but that probate fee tax if you will, trying to reduce that, maintain control for when their parents pass. Or alternatively just the opposite. Again, for minor children they may be holding onto the accounts.

So, different examples of these bare trusts. And as you start to think about the bare trusts in your specific situation, you may find it takes a little bit of time to think about, “oh yes, I’ve got this, I’ve got this one, I’ve got that.”

We’re going to need your help as the accounting advisors and, and those preparing those tax returns to get those down because we’re not going to know all of them and we need you to be taking some effort here, I’m afraid in contrast to what’s ever been done before. We need to ensure we don’t miss any of these.

New filing requirements for bare trusts: Deadlines

So, next up in terms of the filing, if you will. Previously, we never had to file a tax return for a bare trust from a tax perspective. For lack of a better word, and non-technical language, it really wasn’t considered a trust. Now rightly or wrongly, it is what it is. So, we have a filing requirement or deadline and that essentially is going to be by either March 30th or March 31st, depending whether or not there was a leap year, we have to file what we call in T3 tax return. And your physical year end of that is going to be December 31st. Meaning that all the activity on a calendar year basis is going to be reflected in the tax return because of that due date.

Believe it or not, it’s coming up quick and your accounting advisors, to give some perspective, are going to have really gangbusters activity within their offices taking care of or trying to address December year ends. They’re going to be trying to address T4, T5 deadlines, contracting reporting deadlines, trust deadlines, partnership deadlines, and of course the ever-popular deadlines relating to personal tax returns. And if there’s not another extension, perhaps we’re going to have a deadline for UHT returns as well. And with those UHT returns, I know I’m off topic, but not just 2022’s, but 2023’s as well.

Additional disclosures for bare trusts

So, back to our bare trust and our filing requirements and, here we do need, you can see from the slide more disclosure. So, as part of Revenue Canada’s, let’s call them reforms, I don’t know if that’s the right terminology to use or not. They’re looking for more information and while that information in and of itself does not trigger taxes, and the kind of like name and address type of details, who’s involved it, it does require a little bit more forethought, particularly for our discretionary family trust. The bare trust will probably be relatively straightforward in terms of what we’re looking for, but we’re going to have to identify who possibly can receive assets as compared to necessarily who’s again on title if you will. So, go through with some vigor. It is going to be important to identify all of these.

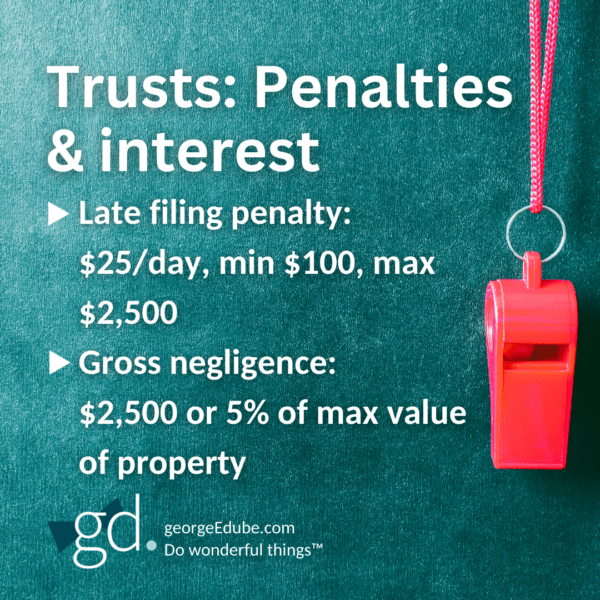

Penalties and interest for not filing trust returns

In terms then of what we’ll rephrase or phrase as the carrot and stick approach. Well, I don’t know that there’s so much a carrot, but there’s definitely a big stick. And so, the ever-popular penalty of $25 a day, minimum of a hundred dollars, maximum of $2,500 still exists. But those penalties have been around for quite a long time. So, Revenue Canada wanted to up their game and what they’ve done to help with that (help is a very strong terminology; perhaps that’s the opposite, but whatever), they’re going to go with a series of penalties. I shouldn’t say series. It’s a penalty. And where they allege gross, or are successful, in proving gross negligence, they can charge you the greater of $2,500 or 5% of the value of the assets in the trust.

So, if you have a medical professional company, for example, that has various investments, then the practice itself, maybe that’s worth $5 million. Revenue Canada will be delighted to charge 5% on that. Maybe you’ve got a bare trust where there’s a piece of real estate worth a million dollars, maybe your parents’ investment accounts are a couple of million dollars. Again, you can do the calculation of 5% fairly easily. It’s a big number.

And keep in mind it’s not just 5% this year, but being practical about it, Revenue Canada likely speaking won’t be auditing a lot of these in the next few months. They’re going to wait a few years and now they’ve got three years they can audit at once. Now they’ve got three years of penalties, three years of 5%.

And certainly, those experienced in the audit field will know that Revenue Canada way too frequently in my personal opinion, will allege gross negligence. And so may or may not be successful in arguing it, but we are arguing it in many cases.

I expect will there be a little bit more leniency in the first year possibly. Do you want to bet 5% on it? I wouldn’t. But to each their own.

Next steps on bare trusts

Next steps, figure out all the possibilities you may have with bare trusts. Talk with your accounting manager, your accounting partners. Let’s find out exactly what we do have and, and we would love to be getting started on these in the current year, but certainly very, very, very early in the new year because as we get closer to March 31st, it becomes more and more of a challenge to get work out period, but certainly on a timely basis.

And we really do not know the number of bare trusts we’re dealing with here, but I expect it’s going to be our gargantuan number. So, for our office, I’m sure it’s going to be a thousand plus, whereas the number of trusts we normally would go through and I stand to be corrected, but just kind of guesstimating what that may look like. Say it’s a couple hundred. So, for us there’s a significant amount of additional activities that are taking place.

Your particular advisors or their team with BDO may have different numbers. But there’s going to be a lot of stress, I would suggest coming up to March the 30th or 31st, and what happens if we’ve missed one. So, please work with us. Let’s get these identified. We don’t want to see you pay those penalties any more than the next person. I’m quite confident you can spend the money far better than sticking it towards penalties.

If you’re interested in saving more taxes in different ways, please do look at our YouTube. Subscribe and feast on the information available now and which is coming out shortly. Thank you.

Have more questions?

Please subscribe, follow, and even share.

I want all of us to have the tax information we need to do wonderful things™.

-End transcript-

Resources

For additional resources related to trusts:

- Family trusts: Ultimate FAQ for real estate investors

- Family trusts for medical professionals: Saving taxes

- Paying kids to save taxes: Here’s how in Canada

More questions?

Still have questions? I want to help you Do Wonderful Things™, so please contact me today.

Remember – circumstances are unique! This information is summary in nature. Seek out advice from your tax advisor about your specific situation.