Today, I’m delving into the realm of investment opportunities—specifically, investing in a limited partnership (LP). As someone who works with many General Partner/Limited Partner structures – whether it is clients who are setting up a GP/LP on a real estate deal, clients investing as LPs, or investing in LPs myself, I often field inquiries about LP investments. This post and video aim to unravel the complexities, advantages, and considerations surrounding investing in limited partnerships, tailored especially for those keen on exploring avenues for passive income, whether in real estate or non-real estate ventures. So, buckle up as we navigate through this wealth of information, offering insights and guidance for potential LP investors in Canada.

Note that you can watch the video or read the transcript below.

Video Transcript: Investing in a limited partnership (LP)

Let’s talk about investing through a limited partnership.

I’m George Dube, saving the world from tax, one bow tie at a time™.

While I’m not an investment advisor, and I’m not saying that you should invest in limited partnerships, I do often get asked about this topic. Usually it’s someone looking for or at a real estate deal. That said, there are a number of non-real estate ventures that also use limited partnerships. So I’ve put together some points on investing in limited partnerships, LPs for short, to help you learn more and use a basis when talking with a qualified investment advisor.

What exactly is a GP/LP structure?

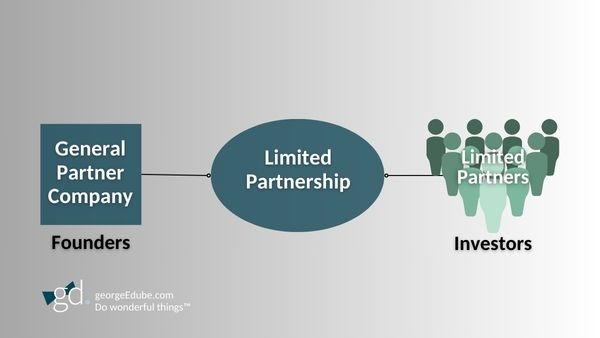

Let’s start with the basics. What exactly is a GP/LP structure and real estate investing? This arrangement involves two key roles for, for that matter, any LP structure: the General Partner and the Limited Partner or Partners.

The General Partner typically manages the investment project, makes decisions and assumes greater risk. The GP, if you will, or the owners of the GP, are the founders who find the deals, structure the investments, complete reporting, perform due diligence, and manage the property or the investment.

The Limited Partners are the investors like you, and in many cases myself, LPs contribute capital and have a passive role within the limited liability structure. They often have no real estate experience, even though they’re investing in a real estate project. Often they’re accredited investors. Securities regulations require that they have specific levels of income and assets, in a variety of cases, and understand the risks of this type of investing. By using accredited investors, founders reduce the compliance costs of investments significantly and therefore can increase the profits for Limited Partners, in theory.

As one example, medical professionals are often occupied with demanding schedules. They may find the LP role appealing due to its passive nature. You can invest your money without the day-to-day management responsibilities while still diversifying your portfolio.

8 pros of investing in a limited partnership

Let’s explore the pros and cons of the GP/LP structure. For those of you who want to use an LP to invest in real estate, or other ventures, there are eight main advantages for you to invest in a limited partnership.

1. Diversification

Advantage one: Diversification. Investing passively as an LP allows diversification across multiple real estate and non-real estate projects, therefore, reducing risk.

Personally, I love serving up a smorgasbord of LP investment choices for my clients. Reach out at my contact information below to talk more about this.

2. Passive income

Advantage two: Passive income. Real estate investments often generate passive income, potentially supplementing your other earnings, whether now or in the future. Depending on the structure of the investment, you can have multiple options for how you’re making income. They may include:

- Monthly payouts to you in cash

- DRIP investing, dividend reinvestment plan if you will, where your monthly payout is instead reinvested into the LP for additional units, sometimes at a discounted price

Note, however, that for some GP/LPs, the payouts are held back until a certain point of time in the investment such as the sale of a building or maybe a refinancing of the project and so on. Ensure your objectives match the intention of the GPs plans.

3. Professional management

Advantage three: Professional management. GPs with expertise handle day-to-day operations. Alleviating the need for your active involvement so you can invest in real estate without having to become an expert in investing in real estate, managing properties, scouting deals and so on. Ensure the founders have credibility, integrity, and the ability to do what they say they will do. The fact that they have gone through the work of setting up a GP/LP structure is an indicator that they may be themselves more sophisticated.

4. Limited liability

Advantage four: Limited liability. Another advantage in investing in the LP structure, making it clear I am not a lawyer, is that it is often providing limited liability for investors. Again, discuss the specifics with your legal advisor.

5. No financing guarantees

Advantage five: No guarantees. If you’re investing directly in real estate, for example, if a healthcare professional buys a medical building for their practice in a corporation, normally you must provide a personal and/ or corporate guarantee to obtain financing. However, if you’re investing as a limited partner, normally you will not be providing a guarantee for the project financing.

6. Tax benefits

Advantage six: Tax benefits. And while there are many, I’ll highlight a couple of particular points.

The tax benefits of investing in an LP is one of the most attractive for investors. The GP/LP structure is what we’ll call a flow- through structure for tax purposes. In the GP/LP structure, the limited partnership flows through its activities to investors based on their invested funds. For instance, in a real estate project that generates rental income, investors receive a share of the rental income after deducting expenses and report this money as rental income on their tax returns on the other hand. In a development project that involves selling condo units, for example, investors get a proportional share of the sales as if they sold them themselves. The nature of the income from a tax perspective is retained.

The limited partnership itself doesn’t pay income taxes. This allows investors to choose how they want to be taxed. They can invest individually, through corporations, partnerships, family trusts, joint ventures, whatever, but they’re shaping their tax implications based on what suits their specific needs. This differs from the traditional corporate setup where all investors are subject to the same tax implications dictated by the corporation structure.

7. Leveraged investing without affecting your credit

Advantage seven: Leveraged investing without affecting your credit. By investing in the LP, you can use leverage to invest without using your own credit room. The GP arranges for financing for the project, which can help increase your profits or, if things don’t go well, increase your losses, the nature of leverage. But this credit will not generally impact your credit. So when you want to buy a new home cottage, other leveraged investments, you aren’t losing any additional room unless you borrow to invest, which then again steps up your leverage ability using the LP.

8. Supercharge your legacy planning by borrowing to invest

Advantage eight: Supercharge your legacy planning by borrowing to invest. Combined with the right structure, you can really supercharge that legacy planning. For example, creating a family trust and using other people’s money to pay for your taxes will help stretch your investing dollars so that you can grow your wealth by investing in different LPs. See our video series on this advanced topic about using OPM to pay for your taxes and build wealth at the same time.

4 cons of investing in a limited partnership

So what are the cons of investing in a GP/LP investment? From the investor’s perspective, there are four main disadvantages.

1. Limited control

First, limited control. Limited partners have limited control over decision making, relying on the GPs for strategic choices, and in fact, they may have negative legal consequences again, to be discussed with your lawyer if you do get involved in the decision making.

2. Higher risks with GPs

Disadvantage two: Higher risks with GPs. GPs bear more risk and responsibility in the investment, which can affect LP returns if the project underperforms. More players, more assets, more risk, although the opposite can also be true.

3. Capital commitment

Disadvantage three: Capital commitment. Limited partners need to commit funds for a specific period of time, which limits your liquidity. In other words, the cash is tied up. If you need cash on hand, this may not be right for you.

4. Registered funds limit options

Disadvantage four: Registered funds limit options. If you want to use registered funds such as an RRSP to invest, not all LPs qualify as eligible investments. Some certainly are set up so they can.

4 tips for investing in a limited partnership

If you’re thinking of investing in a GP/LP, here’s four pieces of advice that can help.

1. Perform due diligence

One, due diligence. Research GPs thoroughly. Look into their track record, expertise and the projects they’ve managed. By here I’m referring to the founders of the GP.

2. Understand terms

Understand the terms of the agreements, reading the partnership agreement carefully understanding your rights obligations, potential risks.

3. Diversify

Diversify. Spread investments across different GPs, real estate and non-real estate, perhaps different geographies. Perhaps you’re looking in many cases to minimize the risk. And I appreciate as a real estate investor, my definition of diversifying is going to be very different than a stereotypical definition. Now you need to find what’s appropriate for you.

4. Consult professionals

Consult professionals. Consider consulting financial advisors, real estate experts, whomever, before making significant investment decisions. Work with them to ensure the investments fits into your tax, legal, legacy, and retirement planning objectives.

Opportunities for investing in a limited partnership

Real estate investment through the GP/LP structure can offer you an opportunity for passive investment income portfolio diversification. However, it’s crucial to conduct thorough research, understand the risks, consider professional advice before taking the plunge.

If you have any questions on investing in limited partnerships or potential investment smorgasbord ideas that can work for you, my contact information is below.

You can also check my other videos for more tax planning and wealth building tips.

And remember, click the Subscribe button to stay up-to-date.

I want all of us to have the information we need to do wonderful things™. Thank You.

-End transcript-

Resources

For additional resources related to Investing in a limited partnership (LP), or wealth and tax saving tips:

- Using OPM to pay your taxes

- Family trusts for medical professionals: Saving taxes

- Paying kids to save taxes: Here’s how in Canada

More questions?

Still have questions? I want to help you Do Wonderful Things™, so please contact me today.

Remember – circumstances are unique! This information is summary in nature. Seek out advice from your tax advisor about your specific situation.