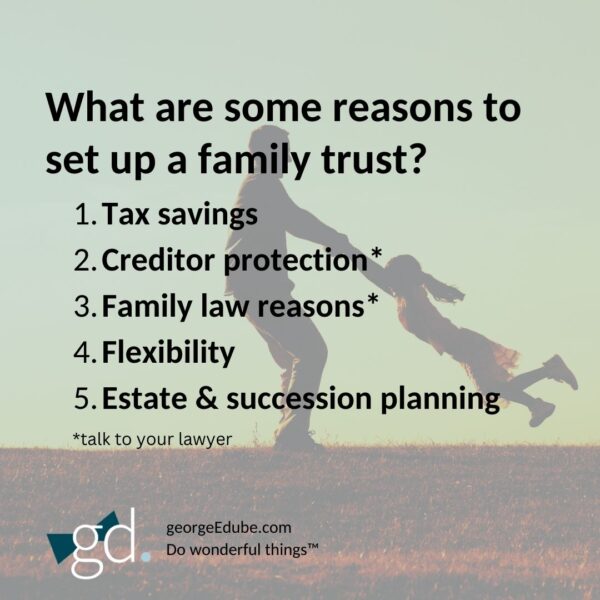

As someone passionate about maximizing wealth while minimizing tax burdens, I’m excited to unravel some of the mysteries behind why setting up a family trust in Canada could be a game-changer for you. Whether you’re real estate investor and medical professional, this discussion holds immense relevance for safeguarding your hard-earned assets. So let’s explore the question of “why set up a family trust”.

Video Transcript: Why set up a family trust in Canada?

Why should we be setting up a family trust if we’re, whether we’re a real estate investor, business owner, investor, whatever that means.

I’m George Dube, saving the world from tax one bow tie at a time.™

There’s going to be a number of reasons that we look to, and those reasons will have different levels of importance for different families.

Tax savings with a family trust

Often I like to start off with considering what ultimately is going to happen with assets when, whether it’s a second of mom and dad pass away, where a typical will situation will be set out such that all of the assets of the initial spouse passing away will pass along to the widow. But if we kind of go forward with that, whether it’s at the first passing or the second, and there’s a variety of instances where it may be the first passing. Roughly speaking, very, very roughly speaking, we may be giving up 25% of our estate essentially to Revenue Canada. If we’re liquidating assets within a corporate structure as an example, it may be a lot closer to 50%.

So with that family trust, well the family trust itself does not pass away. And while a corporation doesn’t pass away, mom and dad who are owning the shares of that corporation can pass away, whereas the family trust does not.

Remember the family trust, it owns and controls, meaning that there are not individual shareholders, there are beneficiaries that may receive assets. So with that family trust, if we’re able to defer the tax even at the lower amount of roughly 25% of an estate, and that’s again a very, very rough approximation, that’s a huge benefit to have that 25% working for the next generation.

Creditor protection with a family trust

There will be clients that will focus on some of the creditor protection aspects of the family trust.

Family law reasons to set up a family trust

There may be family law aspects and again, on legal matters. Highly, highly recommend speaking with your legal advisor on those.

Flexibility and family trusts

I love the flexibility of a family trust that flexibility allows the beneficiaries to receive income or assets. Typically dividends from a corporation, or the corporation shares themselves, where mom and dad are looking at more of the estate succession planning arrangements. They may be trying to figure out how they’re going to divide their estate.

And so for example, if there are two children, are things going to be divided 50/50? Maybe, maybe not. The trust allows us to decide later on who should get what and fair may not be a 50/50 split, particularly where there may be one of the children who are working heavily in the business and another child is not. Would 50/50 be the desire of mom and dad?

Where again, as a further example, one of the two children has two children of their own and the other has seven or eight children. What happens if one of those grandchildren has some form of mental, physical impairment that some additional funds would really help out with and get them further along?

Again, those types of decisions, maybe something mom and dad do not have the capability of making today, and in most cases we don’t. I mean, clearly we’re going to know more in the future in terms of what we should or shouldn’t do. The family trust allows us to hold things into place and gives us that flexibility.

We also have the flexibility in deciding who gets what income. Well, we can change things as time progresses based on income levels, participation, other factors going on.

Estate and succession planning

We can do a variety of estate and succession planning where we’re saying, let’s wait till we have more information, but we want to lock in the tax benefits today.

Have more questions? Please subscribe, follow, and even share.

I want all of us to have the tax information we need to do wonderful things™.

-End transcript-

Resources

For additional resources related to why you should set up a family trust, see:

- What is a family trust?

- Family Trusts: Ultimate FAQ for Real Estate Investors

- Family trusts for medical professionals: Saving taxes

- Paying kids to save taxes: Here’s how in Canada

More questions?

Still have questions about why you should set up a family trust, or others? I want to help you Do Wonderful Things™, so please contact me today.

Remember – circumstances are unique! This information is summary in nature. Seek out advice from your tax advisor about your specific situation.