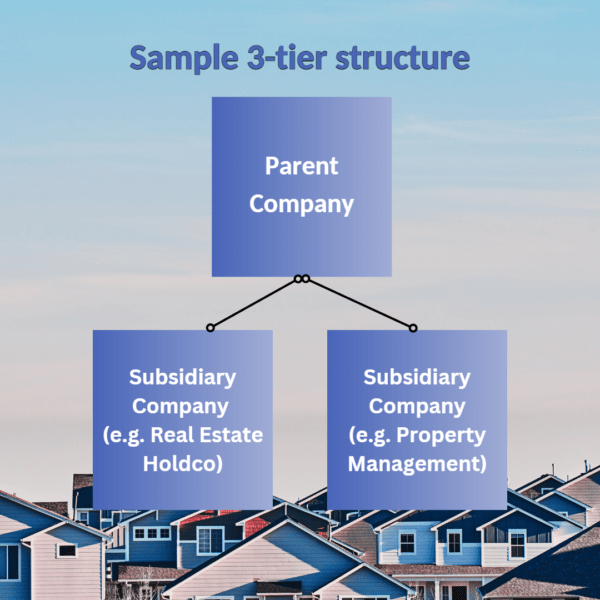

As a real estate investor, are you considering setting up a three-tier structure in Canada? It’s a common question we receive, but I must admit that I’m starting to feel disappointed with this query. When I first started out investing, I in fact used this structure myself, with a parent company holding one or more subsidiary companies, but times have changed. Check out the video for more up-to-date thinking on a three-tier structure, and why they could cause Canadian real estate investors problems.

Video transcript: Three-tier structure

Should I set up a 3-tier structure?

I’m George Dube, saving the world from tax, one bow tie at a time®.

Again, a common question that we receive that’s now starting to disappoint me.

And the reason for that is that that type of structuring was something even myself, no question absolutely used to recommend on a very, very regular basis.

But that changed several years ago.

Revenue Canada introduced rules that effectively for in particular long-term hold real estate investors created a double tax by setting up this 3-tier structure. And if you’re not aware, while those different versions of what a 3-tier structure is, it normally involved at least a parent company owning one or more subsidiary companies.

And the concept at the time was marvelous. It worked like a charm. That was several years ago, and I have very few clients that like paying tax the first time. They certainly don’t like it the second.

So I think it’s now time to admit in the vast majority of cases for long-term hold real estate investors and others, but not all, that 3-tier structure has now been replaced, really in my mind, by a completely different structure.

Thanks for watching and again, that’s summary in nature, there’s a lot more to it that will also be dependent on your particular situation.

Have more questions? Please subscribe, follow and even share.

I want all of us to have the tax information we need to Do wonderful things®.

-End transcript-

Resources: Three-Tier Structure & Corporate Structures

For additional resources related to 3-tier structures and better options for real estate investors regarding incorporation, see:

Back to: Buying real estate in a corporation: Ultimate guide for Canadian real estate investors

More questions?

Still have questions? I want to help you Do wonderful things® with your real estate investments, so please contact me today.

Remember – circumstances are unique! This information is summary in nature. Seek out advice from your tax advisor about your specific situation.