Join me in this comprehensive breakdown of the Smith Manoeuvre, a strategy to make home interest tax deductible. I’ll unravel the complexities of what the Canada Revenue Agency calls “cash damming”, but is more popularly known as the Smith Manoeuvre, and how it can revolutionize your tax game.

In this video, we dive deep into converting your personal mortgage on your home from ‘bad debt’ to ‘good debt’ for optimal tax benefits. With interest rates on the rise, understanding and implementing this strategy is more lucrative than ever. Whether you’re into real estate, stocks, mutual funds, or even investing in your own company, this tactic could be a game-changer for maximizing your tax deductions. But remember, this isn’t a one-size-fits-all approach. It’s for investors willing to leverage borrowing capacity to make their money work harder.

If you’re intrigued by the possibility of unlocking untapped deductions, it’s time to explore the Smith Manoeuvre. But before diving in, consult with your financial advisors to ensure it aligns with your investment goals and financial strategy.

Video Transcript: Making your home interest tax deductible: The Smith Manoeuvre

Good day.

We’re going to talk about the Smith Manoeuvre. How to make the interest on your home tax deductible.

I’m George Dube, saving the world from tax, one bow tie at a time.

What is the Smith Manouevre?

So what’s the Smith Manoeuvre? In tax parlance the Canada Revenue Agency calls this cash damming and certainly the Canada Revenue Agency is pro cash damming. That’s not an issue. The catch is we have to do it correctly.

Overall, from a tax perspective, what we’re trying to do is have that mortgage converted from bad debt, meaning that it’s not deductible, to good debt. And with increasing interest rates now compared to where they were for a roughly speaking, 10, 15 years, this is going to become more and more important and getting the tax deductions from this will be more and more lucrative for you.

Example: Making home interest tax deductible

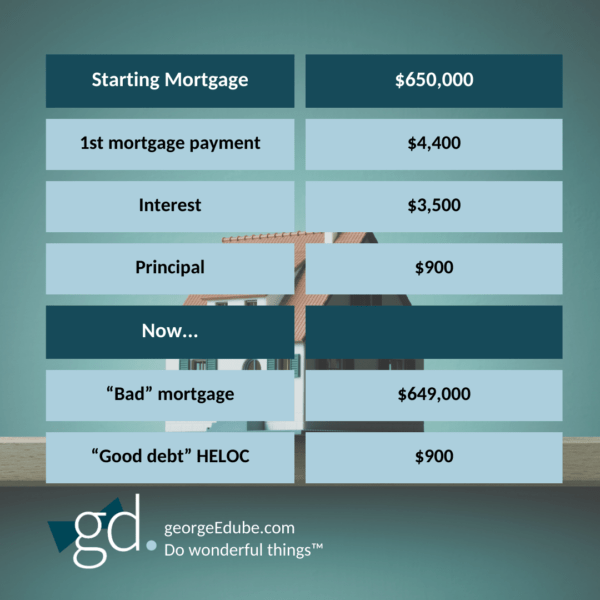

So let’s go through a particular example. So here we have a million-dollar home, and while recent rules have restricted the amount of leverage we can place on the home, we’re now limited to 65%. But 65% is still better than zero, but it’s not as good as the 75% or 80% we were formally allowed.

So with that mortgage, we’re going to start off and make our first payment. That first payment in this example is going to be $4,400. So common to most mortgage payments there’s an interest and a principal component. The beauty of this part is this debt is really going to be, if you will, in two debts:

- the good debt and

- the bad debt.

So as we pay the principal on the bad debt down, we have principal available on the good debt, in this example, $900, after that first mortgage payment is freed up on the HELOC (home equity line of credit) that’s now available. That now creates an opportunity for us to borrow that money for tax deductible purposes, such as:

- your utility expenses, property taxes for the rental property, or

- we can also be getting into other types of investments and whether those are as originally designed by the program years ago, it may be liquid investments in terms of mutual funds, stocks, things of that nature

- we can also be investing in our own corporation.

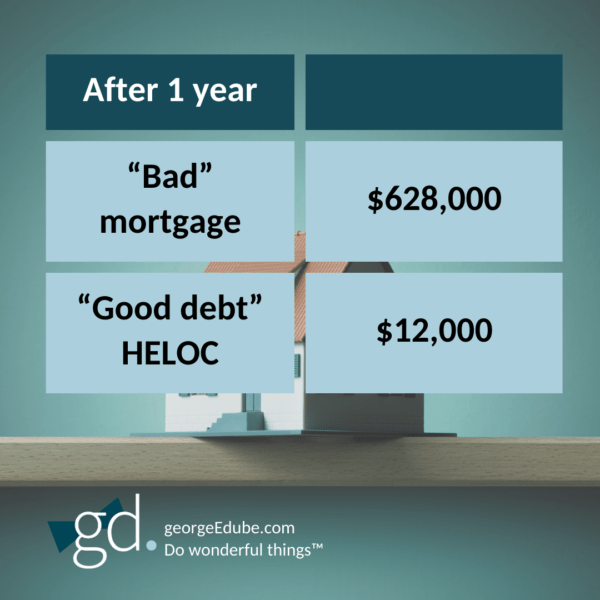

So here, after a year, we’re going to have accumulated that line of credit to a balance of $12,000. Again, that interest now is going to be deductible on the $12,000, not on the $628,000 and not on the $650,000 that previously existed.

Super charge the Smith Manouevre: Making home interest deductible

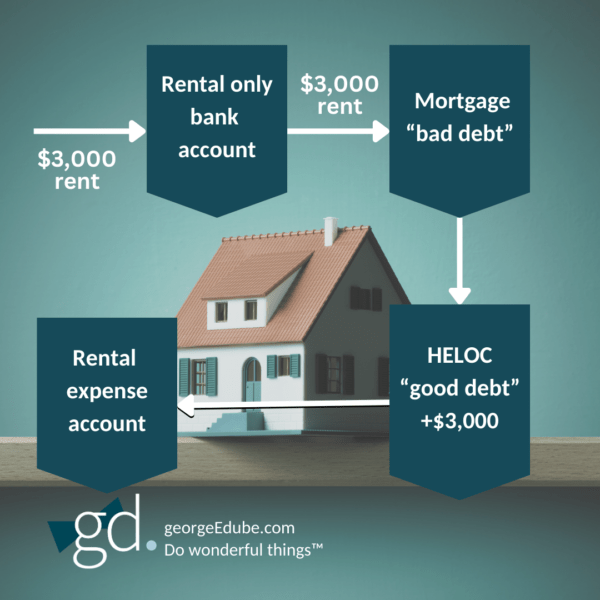

We also now have an ability to super charge the Smith Manoeuvre. This works really, really well if we have a personally owned piece of real estate that we’re renting. For various reasons, and you’ve seen probably some of my different videos, I’m not generally speaking a fan of personally owning rental properties, but let’s say for whatever reason we do have one.

And so here it’s going to be important to set up the correct accounts.

- So now we’re going to have $3,000 in our example coming in from rent. That’s going to go to the rental only bank account.

- From there you can see we’re taking that rent and we’re going to place it against the bad mortgage.

- So, we’re going to free up $3,000 of credit space on the HELOC that’s now available for us to borrow against from that HELOC.

- Now we’re going to pay again the property taxes, utilities, repairs and maintenance, whatever it is that’s directly related to the property, creating that deductible expense and creating that interest expense as the interest is now, or sorry, the principal is now going to a qualifying expense and therefore the interest is deductible.

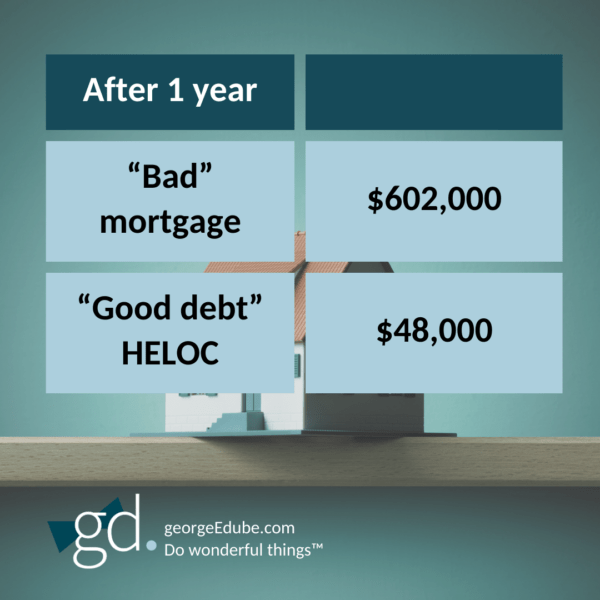

After the year, we’re going to have a lot more, as you can recall from our prior example, of space that’s now being used by the HELOC and fully deductible, that interest is now in our example, or sorry, the principal is now $48,000 on which that interest is going to be deducted. And so, you can see after one year what a tremendous difference that makes. And imagine what happens in years two, three, et cetera. Quickly, we’re going to convert that bad mortgage to a good mortgage. Again, good meaning we have some deductions available.

Traps to avoid when making home interest deductible

There are some traps. And again, keep in mind this is a simplified example. There’s other little gotchas that are involved here. So please talk to somebody who’s familiar with the process and can help steer you clear of this. This is not the opportunity to kind of take the fast way out or cheap out on doing this.

Tracing

So, one is in terms of what Revenue Canada calls tracing and here, what they mean is they want to be able to directly go from that good line of credit to an eligible expense. And hence, I like seeing the different bank accounts. So it makes it super easy for an auditor to go in, tick, tick, tick. Yep. Everything’s doing what it’s supposed to be doing life is good.

Correct bank accounts

We want to have the correct accounts. Again, this is not the time to cheap out on bank accounts. I appreciate it’s going to cost a few extra bucks to set this up, but you saw from our examples what a tremendous difference it makes getting those interest deductions.

Proper banking

For proper banking, we’re going to effectively need two loans on a property. And so that’s effectively the bad mortgage and the re-advanceable, good mortgage. Again, make sure your institution can handle that. And all the big banks, major credit unions, et cetera. I’ve never seen one that cannot handle that. But you may have to ensure that the person you’re dealing with at the institution has it available for you. In your case, it goes without saying, right? I expect, but in our example, you always had $650,000 of debt. We were just differentiating between good and bad.

Comfort with debt

So, if you don’t like debt, you don’t like the idea of borrowing to make money, this idea is probably not for you because you’re going to want to keep paying down debt and accept the fact that you’re not going to have the tax deductions associated with it. But if you are an investor that can accept that, leverage the borrowing capacity and make your money work harder for you, this is probably something that’s just about perfect and it really needs to be done now with the higher interest rates, maybe you’re not experiencing today, but as you go to requalify, more and more important for you.

The Smith Manouevre – Find out if it is for you

So overall, this is an opportunity whether you’re a real estate investor, whether you’re investing in stocks, mutual funds, alternative investments, you’re investing in your own company, lots and lots. So please, if this is something where you’re thinking “I’m not deducting all the interest, I think I may be able to get”, please talk with your advisors. Feel free to reach out.

And as well, we have a variety of other ways of helping build your wealth on an after-tax perspective. Please do check out more of our videos.

Thank you and have a great day.

Have more questions? Please subscribe, follow, and even share.

I want all of us to have the tax information we need to do wonderful things™.

-End transcript-

Resources

For additional resources related to building wealth and saving taxes, please see:

More questions?

Still have questions? I want to help you Do Wonderful Things™, so please contact me today.

Remember – circumstances are unique! This information is summary in nature. Seek out advice from your tax advisor about your specific situation.